Table of Contents

If you’re running your business on Shopify, then you know the importance of having a seamless and secure payment process for your customers.

Convenience is key, so finding the right Shopify payment method can make all the difference in boosting your sale. In fact, according to a study by Weave, merchants who offer multiple payment options have a 30% higher conversion rate than those who don’t.

In this article, we bring you the top 9 best Shopify payment methods for your online store in 2023!

From Shopify Payments to Amazon Pay, we’ll explore the various choices available to help you streamline transactions and take your business to new heights.

Let’s dive in!

| 💡 Recommended reading: |

What are Shopify Payment Methods?

Shopify payment methods refer to payment solutions allowing customers to pay for the products they purchase from your Shopify store.

Through an integrated payment gateway, the payment provider starts processing the transaction when your customers initiate payment for products they purchase from your Shopify store.

It sends the confidential details of the paying customer to the bank issuer for the card used for the transaction. At this point, a response is sent to the payment provider to let them know if the transaction went through or failed.

If you have to handle large transactions, the Shopify payment methods employ more stringent measures to verify the customer’s account before processing the transaction.

The payment provider performs other security procedures like Address Verification System (AVS) checks and velocity pattern analysis. Some Shopify payment methods can calculate the payable tax on transactions you have received.

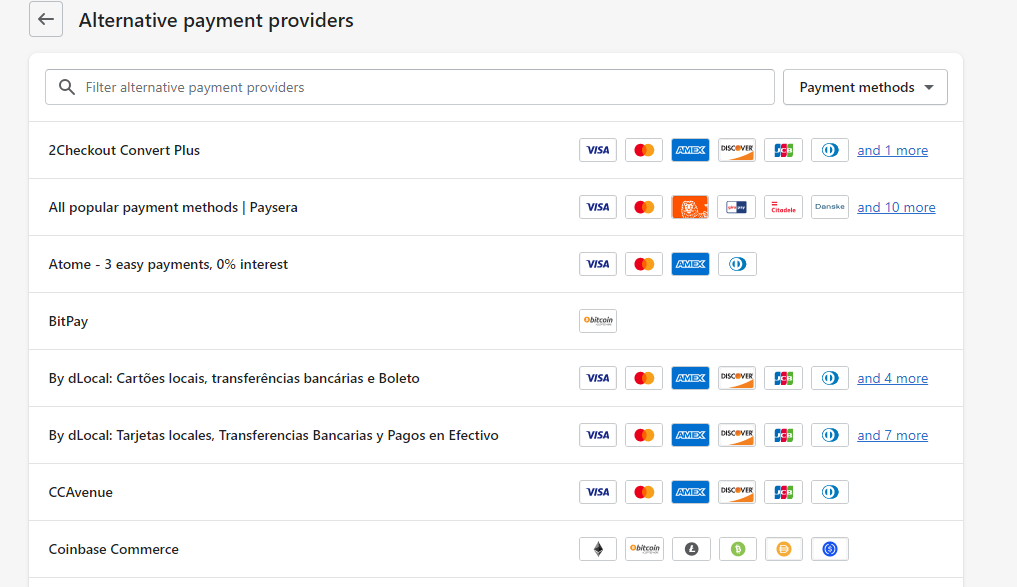

Lists of Shopify Payment method alternatives

| 💡 Want to learn more on how to set up Payment methods and more for your Shopify store?

Check out our guides: |

Features of a Good Shopify Payment Method?

When it comes to selecting Shopify payment methods, there is no one-size-fits-all solution. Each option has its advantages and disadvantages, making it more suitable for specific types or sizes of businesses.

To ensure you choose the best Shopify payment methods for your store, there are some important factors you need to consider:

- Security: Your customers’ data should be safe and secure. Your Shopify payment method should use industry-leading security measures to protect your customers’ financial information.

- Acceptability: The payment method should be accepted by a wide range of customers. You don’t want to lose sales because your customers can’t use their preferred payment method.

- Convenience: The payment method should be easy for you and your customers. It should be quick and easy for customers to checkout, and it should be easy for you to manage payments.

- Fees: Shopify payment methods should have reasonable fees. You don’t want to pay too much in fees, especially if you’re a small business.

- International support: If you sell to customers in other countries, you’ll need a payment method that supports international payments.

- Recurring billing: If you sell products or services billed regularly, you’ll need a payment method that supports recurring billing.

- API integration: If you want to integrate your Shopify store with other applications, you’ll need a Shopify payment method that offers API integration.

9 Best Shopify Payment Methods – Key Features, Pros & Cons

#1. Shopify Payments

Starting our list of the best Shopify payment methods is Shopify Payments, a payment solution owned by Shopify.

Best Shopify payment methods #1: Shopify Payments

It provides store owners with every feature and solution they need to manage and process payments on their website without involving any third-party solution.

This payment method comes with a free card reader for physical payments, and payments made by customers typically take up to 3 business days before reflecting in your bank account.

The regular transaction fee of 2.2% that Shopify charges with other third-party payment methods is not charged with Shopify Payments, which reduces your running costs.

It also offers lower credit card transaction fees when you choose to upgrade your Shopify subscription plan. The interface is simple, making it easy to use for both store owners and customers.

Best of all, Shopify does not require you to make any additional payments to set up Shopify Payments; you will only be charged your regular store subscription fee, card managing fees, and other related fees.

Key features:

- Competitive fees: Shopify Payments offers competitive fees, which makes it a good value for businesses of all sizes. It also requires no additional charges for using external payment gateways.

- Fast payouts: Withdrawals are processed within 24 hours, which is faster than some other payment processors.

- Integrated directly into Shopify: Shopify Payments is integrated directly into Shopify, so there’s no need to add a third-party payment processor.

| Pros | Cons |

|

|

| Ideal for: Shopify Payments is a good option for businesses of all sizes, but it’s especially well-suited for small businesses and startups. | |

#2. Paypal

Paypal is an incredibly popular and widely used online payment method that has gained the trust and recognition of millions of people all over the world. It offers a secure and convenient way for customers to make purchases on your Shopify store.

Best Shopify payment methods #2: Paypal

What sets PayPal apart is its versatility – customers can use their PayPal balance, credit or debit cards, or even pay directly from their bank account.

But that’s not all! PayPal also offers buyer protection, ensuring that customers have peace of mind when making transactions. This is widely trusted among online shoppers, making PayPal a well-established payment method that provides a sense of security and reliability.

Along with security, whether you choose a paid or free plan for your Shopify store, you’ll have access to PayPal’s support team. And if you need help setting up subscriptions or recurring payments, PayPal has got you covered.

For Paypal, the basic plan starts at 2.9% + $0.30 per transaction. And if you’re running a large-scale business, there’s the Pro plan which goes for $30/month.

Key features:

- Wide acceptance: PayPal is accepted by a wide range of customers, including those who don’t have a credit card.

- Buyer protection: This means that customers can get a refund if they don’t receive their order or if it’s not as described.

- International payments: PayPal makes it easy to accept payments from customers in other countries.

| Pros | Cons |

|

|

| Ideal for: PayPal is especially well-suited for businesses that sell to customers internationally. | |

#3. Stripe

For Shopify store owners looking for a versatile payment solution that caters to a global customer base, Stripe is an excellent choice.

Best Shopify payment methods #3: Stripe

Unlike some other Shopify payment methods that support only a few currencies, Stripe supports diverse currencies and offers advanced features like one-click checkout and subscription billing.

Though requires some technical skills to set up and use, Stripe stands out for its developer-friendly approach and powerful API. It provides extensive documentation and resources to help you tailor and connect your store with Stripe.

Plus, Stripe also ensures the security of your transactions by offering fraud protection and secure payment processing.

Stripe charges a flat rate of 2.9% plus $0.30 per transaction. For large-scale e-commerce businesses, it offers personalized quotes. For immediate payouts, it charges $1 per transaction, plus an extra $1 for overseas payments.

Key features:

- Wide acceptance: Stripe is accepted by a wide range of customers, including those who don’t have a credit card.

- Easily integrated with other platforms: Stripe can be easily integrated with other platforms, such as Shopify, WooCommerce, and Magento.

- Low fees: Stripe’s fees are relatively low, especially for international transactions.

- API-driven: Stripe is API-driven, which makes it easy to customize and integrate with other systems

| Pros | Cons |

|

|

| Ideal for: Stripe is highly suitable for businesses that sell online and want to accept a variety of payment methods. | |

#4. Authorize.net

Authorize.net is perfect for Shopify store owners who desire a straightforward and secure payment solution that caters to all major credit cards.

Best Shopify payment methods #4: Authorize.net

This payment method is compatible with all major credit cards (like Visa, JCB, Discover, MasterCard, Diner’s Club, and American Express), making it an excellent choice for businesses aiming to provide their customers with a wide range of payment options.

Moreover, with its support for online, e-check, and mobile payment processing, you can easily accept payments from various channels.

It also ensures top-notch security. By incorporating automated fraud detection, card tokenization, and a secure customer management system, this Shopify payment method guarantees a safe transaction environment.

In terms of pricing, it costs a $49 setup fee along with a 2.9% + $0.30 charge per transaction.

Key features:

- PCI compliant: Authorize.net is PCI compliant, which means that it meets the security standards set by the Payment Card Industry. This can help businesses to protect their customer’s sensitive data.

- Fraud protection: This helps reduce the risk of fraud.

- Recurring billing: This feature is good for businesses that sell subscriptions or other products that are delivered regularly.

| Pros | Cons |

|

|

| Ideal for: Authorize.net truly excels for those operating in the online space who desire the flexibility to accept multiple payment methods, including recurring billing. | |

#5. Opayo

Up next on our lineup is Opayo, also known as Sage Pay.

Best Shopify payment methods #5: Opayo

Opayo is notable for its ability to provide advanced features such as fraud prevention tools. Moreover, its support for recurring payments enhances the overall customer experience.

With their reliable system, you gain access to a variety of card terminals, online payments, phone orders, and more. They prioritize the security of transactions and even provide the option for customers to pay using PayPal if they prefer.

However, one drawback of Opayo is its lengthy account verification process, which can take up to 5 weeks. During this time, you won’t have the ability to manage any transactions.

Opayo has a unique pricing structure that sets it apart from other payment methods discussed in this article. Instead of transaction fees, you’ll be required to pay monthly fees starting at 19 GBP (or around $24) for 350 transactions or less per month.

Key features:

- Compatible with all providers: It supports all major credit and debit card providers, as well as alternative payment methods like PayPal in more than 25 currencies

- Fast payouts: This means that businesses can get their money quickly.

- API-driven: Opayo is API-driven, which makes it easy to integrate with other systems.

| Pros | Cons |

|

|

| Ideal for: Opayo is a good option for businesses that sell in the UK and want to accept a variety of payment methods, including fast payouts. | |

#6. Verifone

Moving on to the next option, we have Verifone. This company specializes in providing point-of-sale (POS) solutions to merchants worldwide.

Best Shopify payment methods #6: Verifone

Their offerings include a range of hardware devices like card readers, as well as software solutions like mobile wallets. By choosing Verifone, you gain the ability to accept payments from customers all around the globe while enjoying speedy and secure transactions.

What sets Verifone apart is its comprehensive approach, offering both hardware and software solutions. This means you can equip your business with the necessary tools for seamless payment processing.

Additionally, Verifone goes above and beyond by incorporating advanced features like fraud detection and prevention. With their risk management and compliance section, you can easily monitor potential fraud and privacy concerns.

Moreover, their tax calculation feature simplifies the process of managing taxes for your business.

This Shopify payment method is free. However, you will be charged a fee for each transaction you process. Unlike most other payment methods, this Shopify payment option allows you to choose and pay for only the features your business needs.

Key features:

- Point-of-sale (POS) solution: Verifone offers a POS solution, which can be a good option for businesses that want to accept payments in person.

- EMV support: Verifone supports EMV, which is a security standard that helps to protect against fraud.

| Pros | Cons |

|

|

| Ideal for: Verifone is a good option for businesses that sell in person and want to accept a variety of payment methods, including EMV. | |

#7. Worldpay

Worldpay, a renowned payment gateway, provides comprehensive support for more than 120 currencies and boasts impressive features such as fraud detection and prevention.

Best Shopify payment methods #7: Worldpay

By opting for Worldpay, businesses can effortlessly accept payments from customers worldwide, ensuring swift and secure transactions.

Notably, Worldpay’s ability to accommodate a vast array of currencies makes it an ideal choice for global enterprises. Moreover, this payment gateway offers cutting-edge functionalities like advanced fraud detection and prevention, strengthening the security of your business.

As one of the most trusted Shopify payment methods, WorldPay allows you to effortlessly sell your products online and accept payments through various channels such as online, phone, and credit/debit cards.

WorldPay offers two pricing plans: Standard and Advanced Gateways, priced at 19 GBP (around $24) and 45 GBP ( around $57) per month respectively. The cherry on top is that WorldPay does not levy any charges for refunds.

Key features:

- Global reach: Worldpay has a global reach, which can be a good option for businesses that sell to customers in multiple countries.

- Fraud protection: This can help businesses to reduce the risk of fraud.

- Recurring billing: This is a good option for businesses that sell subscriptions or other products that are delivered on a recurring basis

| Pros | Cons |

|

|

| Ideal for: Worldpay truly shines for those enterprises that operate on a global scale and desire to embrace diverse payment options, such as recurring billing. | |

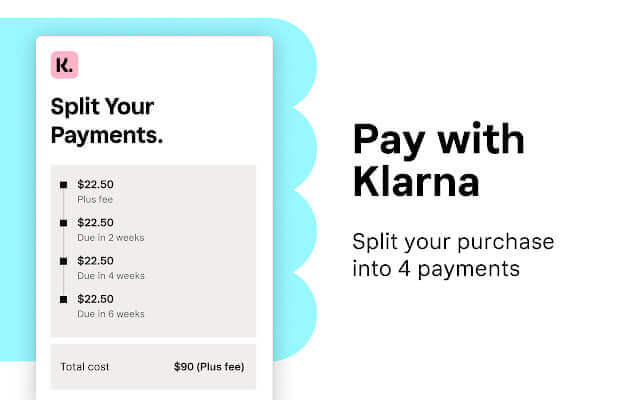

#8. Klarna

Another one on the list of best Shopify payment methods is Klarna. Klarna has the ability to enhance the customer experience through its buy now pay later and installment payment options.

Best Shopify payment methods #8: Klarna

Moreover, this payment solution goes the extra mile by providing advanced features like fraud detection and prevention, guaranteeing the safety of your business.

When it comes to pricing, Klarna keeps it simple. For transactions originating from the United Kingdom or Ireland, you’ll pay a nominal fee of 2.49 GBP/3.16 USD, plus 0.20 GBP/0.25 USD per transaction. Please note that pricing may vary for payments received from other countries across the globe.

Key features:

- Buy now, pay later: Klarna offers a “buy now, pay later” option, which allows customers to purchase products and pay for them in installments.

- Interest-free: Klarna’s “buy now, pay later” option is interest-free, which can save customers money.

| Pros | Cons |

|

|

| Ideal for: Klarna is for businesses that sell products that are well-suited for the “buy now, pay later” model, such as clothing, furniture, and electronics. | |

#9. Square

The last we have on our list for the best Shopify payment methods is Square. With Square, you can effortlessly accept payments from customers worldwide, ensuring swift and secure transactions.

Best Shopify payment methods #9: Square

What sets Square apart is its exceptional features like point-of-sale (POS) systems and online payments, enhancing your customer experience to new heights.

Not only that, Square enhances the workflow and ensures secure transactions through PCI compliance and end-to-end encryption. The extra benefit is the quick transfer of funds to your bank account within one to two days.

Additionally, Square offers a range of useful extensions that can seamlessly integrate into your Shopify store. With its user-friendly dashboard, you can easily keep track of your transactions, cash flow, and inventory.

Square’s pricing structure includes a standard transaction fee of 2.9% plus $0.30 per transaction. For a more comprehensive experience with Square, we highly recommend exploring their premium plan which starts at $12/month.

Key features:

- Point-of-sale (POS) solution: Square offers a POS solution, which can be a good option for businesses that want to accept payments in person.

- Mobile payments: Square supports mobile payments, which can be a good option for businesses that want to accept payments on the go.

- Low fees: Square’s fees are relatively low, which can be a good option for businesses on a budget.

| Pros | Cons |

|

|

| Ideal for: Square is especially well-suited for small businesses and startups. | |

Conclusion

That wraps up our review of the top 9 best Shopify payment methods. Each of these best Shopify payment methods has its unique features, pros, and cons, so you can choose the one that suits your business needs the best.

Remember to consider factors like transaction fees, integration ease, global reach, and customer preferences when selecting your payment method. Happy selling on Shopify!

Can’t wait for more reviews and insights? Stay tuned to OneCommerce Blog for more to come!