Table of Contents

To put it simply, LTV:CAC ratio is calculated by dividing the customer lifetime value (LTV) by the related costs needed to acquire that customer (CAC- Customer Acquisition Cost).

LTV:CAC ratio is one of the most crucial metrics since it signifies whether the money you can earn from a customer is higher or lower than the costs needed to acquire them.

In this article, we’ll walk you through all you need to know about this metric:

- What is LTV:CAC ratio?

- Why does your business need to track LTV:CAC ratio?

- How to calculate the LTV:CAC ratio properly?

- What is a good and bad LTV:CAC?

- 4 tips to improve your LTV:CAC ratio

What is LTV:CAC ratio?

Lifetime value (LTV) shows the average amount of revenue you can earn from a customer from their first to last purchase with your store. Meanwhile, customer acquisition cost (CAC) measures the average amount of costs you have to invest in order to acquire that customer.

| ? If you spend an average of $20 to acquire a customer and an average customer spends $60 over their lifetime, then your LTV:CAC is $60/$20=3 (or 3 to 1).

Compared to the benchmark, this is a good LTV:CAC ratio (which we’ll discuss more below). |

Tracking your LTV:CAC is vital since it will tell you whether your marketing initiatives are well-paid off or not.

Why does your business need to track LTV:CAC ratio?

As you scale up your business, there will be more costs and revenues associated with your day-to-day operations. Therefore, you must closely monitor all your store’s crucial metrics to know whether you’re in the profit zone.

Customer lifetime value, Customer Acquisition Cost and, well, LTV:CAC are those crucial metrics. By accurately tracking your LTV:CAC ratio, you could know the efficiency of your marketing channels.

From there, you can cut down on investment in channels that don’t work and allocate your expenses to more effective channels.

Uncover your exact LTV:CAC ratio

How to track LTV:CAC ratio properly?

LTV:CAC ratio is calculated by dividing the average customer lifetime value by the average customer acquisition cost.

Therefore, to track your LTV:CAC ratio properly, you need to track your Customer Acquisition Cost and Customer Lifetime Value.

What is customer acquisition cost?

Customer acquisition cost refers to all the costs associated with acquiring a customer. Although some companies do not factor in COGS when calculating the CAC metric, in order to know your exact CAC, we highly recommend taking in the COGS in your costs.

So, your true CAC would be calculated as below:

CAC = (Total marketing spends + Cost of Goods Sold) / Total number of customers

In the formula above:

- Total marketing expenses refer to all the costs that you invest in your marketing initiatives. So marketing expenses vary significantly from business to business. A few marketing expenses that you might find related are:

-

-

- Facebook, Google, and TikTok ad campaigns

- Influencer shoutout

- Content marketing

- SEO audit and optimization

-

- Cost Of Goods Sold (COGS) refers to all the material and labor costs needed to produce your finished goods

What is lifetime value of a customer?

Customer Lifetime Value metric is calculated by multiplying your customers’ average purchase value, average purchase frequency, and average customer lifespan.

LTV = Average Purchase Value * Average Purchase Frequency * Average Customer Lifespan

Step 1: Calculate Average Purchase Value

Average Purchase Value (APV) is calculated by dividing total revenue by the total number of orders generated during a specific period.

Average Purchase Value = Revenue / Number of purchases

For example, if you grow $100,000 in revenue from 1,000 orders in 2022, your APV will be $100,000 / $1,000 = $100.

Step 2: Calculate Average Purchase Frequency

Average Purchase Frequency (APF) is calculated by dividing the total number of purchases by the total number of customers.

Average Purchase Frequency = Number of purchases / Number of customers

For example if, in 2022, you have 5,000 orders and your total number of customers is 1,000 customers, then your APF is 5000 purchases / 1000 customers = 5 times.

Step 3: Calculate Average Customer Lifespan

Average Customer Lifespan (ACL) is calculated by summing all your customer lifespans and dividing it by the total number of customers.

Average Customer Lifespan = Sum of customer lifespans / Number of customers

If you’re new and don’t have a large enough sample size for the calculation, you can also calculate your average customer lifespan by deriving it from the churn rate. Churn rate is the rate at which customers stop buying from you over a given period of time.

Average Customer Lifespan = 1 / Churn rate

For instance, if your business has 1,000 customers at the beginning of 2022, but only 900 of them still shop from you at the end of 2022, then your churn rate is (1000 – 900) / 1000 = 0.1.

Then your Average Customer Lifespan (ACL) will be 1 / 0.1 = 10 months.

Step 4: Calculate LTV

After gathering all the metrics you need for the CLTV metric, you can calculate it by multiplying them all together.

With an APV of $100, an APF of 5 times, and an ACL of 10 months, your Customer Lifetime Value is $100 * 5 * 10 = $5,000.

What is a good LTV to CAC ratio?

Now that you know how to calculate your CAC and LTV, the LTV:CAC ratio can be simply calculated by dividing your Customer Lifetime Value by Customer Acquisition Cost.

After doing so, if you see a number around 3 or 4, you’re doing good. This is because an ideal benchmark for LTV:CAC ratio is 3:1 or a bit higher (at 4).

If your LTV:CAC ratio is 1 or lower, you’re spending more than what you can earn. So that means a ratio of 5:1 is perfect right? In fact, nope! An LTV:CAC at 5 or higher implies that you’re restraining yourself by under-investing in marketing.

How to improve your LTV:CAC ratio!

If your LTV:CAC ratio is at 2 or around 1, you’re putting your business in jeopardy. Because in the long run, you won’t be able to maintain and scale it up.

So in order for you to improve this metric, you can either increase your LTV or decrease your CAC. And here are 4 tips to do so!

#1. Closely monitor your LTV:CAC ratio

Calculating your LTV:CAC ratio once a year won’t help. You need to closely track your LTV and CAC on a weekly, monthly and quarterly basis.

By tracking your LTV:CAC over different time frames and then comparing them, you can know whether you’re on the right track or not (making less or more from a customer).

If you’re running a Shopify store, find a profit-tracking tool to help you do so. TrueProfit is highly recommended if you want to view LTV:CAC for different customer segments in real-time.

Uncover your exact LTV:CAC ratio

#2. Remember to segment your customers

Calculating the LTV:CAC for all your customers can give you an idea of whether you’re in the profit zone or not.

However, if you sell a wide range of product lines that vary significantly in value, it’s important to segment your customers into groups and then calculate the LTV:CAC for each group.

This will give you a better understanding of which customers are more profitable and which are not. And you can thereby allocate your resources to acquiring the customers that are more important to your business’s bottom line.

#3. Invest more in organic marketing

Your customer lifetime value can be fine, but if your CAC is too high, it can drag down your LTV:CAC ratio too.

If that is the case, you should definitely invest more in long-term marketing activities (SEO, branding, content marketing, etc.) besides short-term performance ad campaigns.

According to research by Investopedia, businesses with strong brand identities can attract more organic traffic, retain more customers, and more importantly, charge more for the same products that their competitors are offering.

#4. Increase customer retention

The higher your churn rate is, the more it hurts your LTV:CAC ratio. So to improve your LTV:CAC, you should definitely look for more strategies and tactics to boost your customer retention.

According to a study, 69% of consumers say they prefer retailers that offer them reward programs for their purchases.

Therefore, one of the most effective ways is to run a loyalty program for your store. If you run a Shopify store, OneLoyalty is worth giving a shot at. With this app, you can give your customers lots of ways to earn points (make a purchase, follow social accounts, etc,) and reward them with various rewards.

| ? Recommended reading: |

#5. Increase average order value

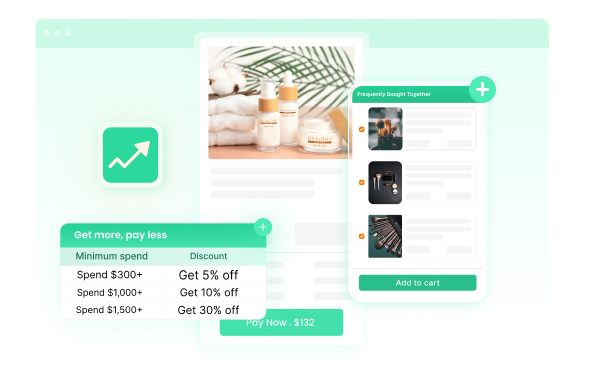

Another way that can help you boost your LTV and improve your LTV:CAC ratio is by using sale-boosting techniques.

Try encouraging your customers to purchase more with ‘Buy More Save More’ discount programs, Frequently bought together product bundles, Quantity breaks, etc.

If you’ve never run a sale campaign before, it’s highly recommended that you should diversify your offers to see which ones your customers find most appealing.

Leverage Promotions To Double Your Sales

Wrapping up!

That’s it! By calculating your LTV:CAC ratio accurately, you can know whether you’re in the right place or not. And we hope the tips we gave will help you improve this crucial metric for your business.

Discover top-tier eCommerce solutions at OneCommerce.io