Table of Contents

You can’t say enough about how important accounting is for your business, especially in e-commerce. You may find yourself in a bind if you only rely on Shopify accounting.

While you can use the platform to generate reports displaying your total sales or income by location, the functionality is quite restricted and insufficient for full expense tracking. In this situation, there are two options: hire an accountant for your business or integrate an expense-tracking app that will handle the work for you.

In this blog, we’ll go over everything you need to know about Shopify expense tracking including which expense you have to keep an eye for, and where to find the tracking feature in Shopify.

What are Shopify expenses?

To succeed in Shopify, start-up owners must understand to keep track of all business transactions on this platform, including expenses and revenues. To put it simply, expenses are the costs of running your company. And there are many different types of expenses for businesses to handle.

Think about the materials you’ll need to make your products, the hardware, and software you’ll need to run your online store or rent for your brick-and-mortar store, your marketing efforts, your employees’ wages, and other expenses.

Here are some of the most important Shopify expenses to keep track of:

- Cost of goods: the amount you paid your supplier for the materials and labor that went into making your product(s)

- Distribution costs/selling expenses: the costs of shipping, insurance, and marketing

- Administrative costs: include things like utilities, salaries, and legal and banking fees.

- Income tax expense: the amount of taxes you have to pay during a certain time period.

- Other expenses: this covers unforeseeable charges such as tax fines and repair costs.

Simply put these categories together to determine your overall expenditures.

Track all your Profits & Losses in real-time

What is Shopify expense tracking?

Expense tracking is a fantastic tool for keeping track of what you spend and how it breaks down into different groups. You need to know your expenses as a basic part of running a business and utilize that information to assist with:

- Forecasting profit

- Making a budget

- Profit per item calculation

- Lowering your costs

- Putting in financial reports and tax returns

- Accounting management

Sales numbers alone can’t tell you what your bottom line will be or if you’re spending too much on something unless you have a Shopify expense tracking list. Therefore, it’s also important to estimate all the costs to keep track of your cash flow.

Shopify expense tracking is crucial for every merchant on this platform

Which expense often includes in your Shopify typical business expenses list?

For many small businesses, the line between success and failure is razor-thin, and eCommerce is no exception. You will have to accept some expenditures if you sell online.

If you want to offer your product or service only online, which we are talking about Shopify, keep in mind the following 9 typical business expenses.

1. Website building and hosting

This is the first expense in the list you have to pay if you intend to build your own website. To make an eCommerce site, you need to do a lot more than just start a WordPress blog.

Online shoppers expect eCommerce companies to have good websites, but even a “just the basics” site will need to pay for a domain name, an eCommerce platform for handling payment processing, SSL certification, and hosting.

2. Platform fees

As mentioned earlier, if you wish to sell things online, you’ll almost certainly need to use the services of a third-party eCommerce platform. In fact, you may forego your own website entirely and simply sell your products through third-party marketplaces. However, if you want to be on the list, you’ll have to pay for it.

Additionally, each platform will charge a monthly flat cost or a percentage of each sale, plus additional final value fees or referral fees. This may range from tens of dollars to hundreds of dollars per platform every month.

Shopify is a top choice for the best eCommerce platform for small businesses because it is easy to use, scalable, and has a lot of essential features but still provides affordable pricing plans.

If you use Shopify to open an online store, in the beginning, you can expect to pay between $250 and $500 in start-up fees and between $50 and $100 in monthly fees, including add-ons.

Have a look at the table below to know which expense your business has to pay.

| Shopify Lite | Basic Shopify | Shopify | Shopify Advanced | |

| Monthly fees | $9 | $29 | $79 | $299 |

| Shopify’s Online Credit Card Processing Fees | 2.9% + 30 cents | 2.9% + 30 cents | 2.6% + 30 cents | 2.4% + 30 cents |

| Shopify’s In-Person Credit Card Processing Fees | 2.7% | 2.7% | 2.5% | 2.4% |

| Additional Fees for Using Third-Party Payments (Transaction Fees) | 2% | 2% | 1% | 0.5% |

| Shipping Discounts | N/A | Up to 77% | Up to 88% | Up to 88% |

| Best for | Sellers that do not require their own eCommerce website | Sellers that require their own eCommerce website as well as multichannel sales capabilities | Volume sellers that want more advanced selling tools than those provided by Basic Shopify | High-volume sellers that require the full Shopify plan’s features to be expanded |

3. Utilities

Remember that as an online business, you’ll need consistent, round-the-clock internet connectivity, which may place a burden on your power cost and would include in your Shopify expense tracking as well.

4. Shipping

When you first start out as an eCommerce business shipping products to customers, your shipping costs and capabilities will be unpredictable.

Typically, only larger enterprises trading in bulk and with more established shipping histories may negotiate with carriers for better deals. So, until you get there, you’ll have to budget for significant shipping fees in your Shopify expense tracking list.

Meanwhile, contact your eCommerce platforms to see what kind of deals they can secure for you, and consider cutting costs by obtaining free packaging from large carriers.

5. Returns and refunds

The now-anticipated benefit of internet buying is the ease of, and frequently free, returns. Supposing you have a generous return policy (which we strongly recommend suggested), you’ll have to enable consumers to return items for a variety of reasons—and occasionally foot the expense of restocking or even getting rid of them.

Refund costs, another Shopify expense tracking item, are very certain to be greater for eCommerce businesses. Because the rate of return orders for internet sellers is over 20% corresponding to an increase in the refund cost for those orders.

This percentage is almost double that of brick-and-mortar businesses and may lead to the loss of marketing and reverse logistics costs.

Return order and refund cost are two of Shopify expenses

6. Equipment and asset maintenance

What “fixed assets” do you use monthly to keep your business running? If you’ve invested in full-scale production equipment for your products or new laptops, your business will suffer if any of those assets fail at any time.

Paying for asset maintenance, disposal, and replacement is an often-overlooked Shopify expense.

7. Sourcing products

This is frequently the most expensive activity you will encounter on your list. Major sellers spend countless hours scouring the Internet for lucrative opportunities.

Imagine sitting on low-demand products, on the other hand, this is a costly and wasteful use of capital. Rather, invest in the right tools to help you find popular, high-need products for your small business.

8. Marketing and advertising

When you start a business from scratch, marketing and advertising can cost a lot more than you think. The average marketing budget is between 7 and 12% of sales, but some businesses would rather spend a set amount.

Marketing and advertising for an eCommerce business can vary, including blogging in conjunction with SEO efforts, social media marketing, targeted ads on social networks, and email newsletters.

You can also hire designers to work on your brandings, such as logos, colors, and packaging, writing persuasive copy for your website, and much more. In other words, your marketing expense is only limited by your willingness to invest in them.

9. Transactional costs

As an e-commerce business, you will only accept credit card or e-wallet payments. And this frequently entails paying a transactional or processing charge for each purchase.

E-commerce platforms often include the cost of securely routing a customer’s payment from their card to your account as part of their packages. However, you should read the fine print to make sure you know what you’re getting.

Why do you need Shopify expense tracking?

For many businesses, you may find it hard to keep track of expenses because they come from various sources. You might have invoices paid through online banking, accounts payable balances, and direct debits – and this every-penny tracking might take hours of manual bookkeeping.

Why do you need Shopify expense tracking?

A system that monitors your expenses makes the process easier, allowing you to:

- Create spending categories and assigned a group of expenses a code. Then, you can see how much you spent every month, week, or day on each one (such as entertaining, shipping, platform fees, or utilities)

- Compare your spending to your income, keeping track of how your expense compares to your sales statistics.

- Plan out your expected costs for the trading season and be on the lookout for possible cash flow problems or times when you can invest in a new business asset.

- Take a photo of a receipt using your smartphone and upload it to your bookkeeping app – you’ll never lose a receipt or have to deal with manual employee expense claim forms again.

As you can see, tracking your expenses, by any means necessary, is always recommended to help you manage your business better. So if you haven’t started Shopify expense tracking already, it is a good time to do so.

10. Deskflex Analytics And Reporting

The Desk Flex reservation system has an efficient tracking system that monitors users’ booking activities. It provides comprehensive information on the different office space status and how often users book these workstations. Consequently, DeskFlex room booking software will guide you to make sound decisions in optimizing the workplace. The analytics and reporting software feature will display on-demand desks or workspaces. Thus, office managers can set up the office according to team member preferences.

How do I track my expense on Shopify?

There are 2 ways for Shopify expense tracking:

- The first option is to utilize Shopify’s expense tracking feature. This tool lets you keep track of your spending by category, allowing you to identify where most of your money is going.

- The second one is to use a specialized expense-tracking app, which could cost you an amount of fee.

We will go through each of them to help you find out which way suits you and your business.

1. Use the expense tracking feature from Shopify

You may have a better understanding of your company’s performance by measuring its Shopify sales and expenses. These business metrics are essential because these data can assist you in making wise decisions about how to deploy your resources (time, money, and energy) to expand your business.

On Shopify, you can simply track your profit by comparing your entire sales against your total costs. This will give you a basic indication of whether or not you are profitable.

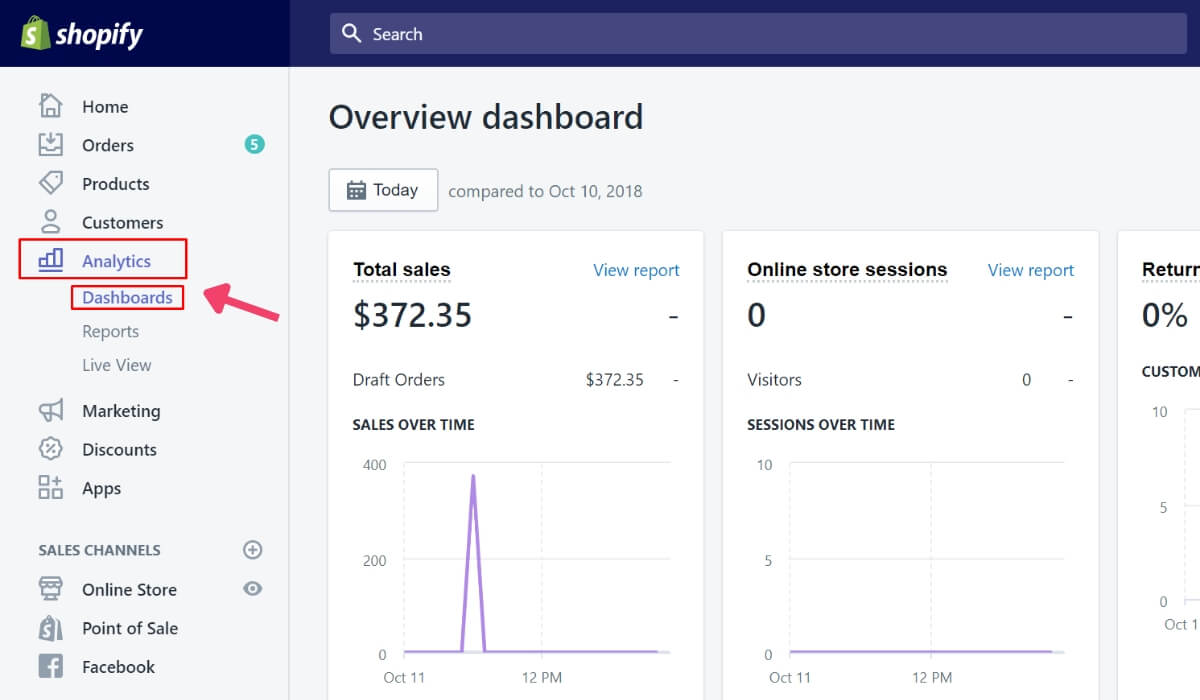

The dashboard is accessible by selecting the ‘Analytics‘ tab on the left side of your screen. There are also more reports available under the ‘Analytics’ page.

Select the ‘Analytics’ tab to see an overview of your business performance

You may examine results for several time periods (day, week, month, and year) as well as reports for certain channels (online shop, social media) or goods. You may also compare the results to the previous times.

The Shopify dashboard gives you a decent snapshot of how your business is doing, but you should look into it more. This is where specialized Shopify expense tracking apps come in.

2. Use Shopify expense tracking apps

On the contrary, you can shift your attention to Shopify apps if the expense tracking from Shopify isn’t suitable. These Shopify expense tracking apps will allow you to integrate with many platforms to have an overview of the whole picture of your business.

There are several apps available that allow you to track your expenses and make reports such as TrueProfit, Accountify, Delirious Profit, Lifetimely, and more. With these apps, you can dive deep down into what is happening in your business.

Especially with TrueProfit by OneCommerce. It offers tons of features to help your Shopify business track all your costs and expenses such as shipping costs, handling fees, ad spends, or any custom costs so you could know your exact profits & losses in real time. Besides, you can also download a mobile app, on iOS or Android, and get email notifications no matter where you are.

Final thought

When starting up, definitely, the goal of every business is to generate a profit and be in business for the long term. When you apply strategy in your marketing and business operations, you can boost revenue and reduce expenses. This is fundamental to keeping you in business.

Thus, understanding the health of your business begins with understanding your Shopify expense tracking—even if it isn’t the most exciting part of running a business.