Table of Contents

Many companies nowadays frequently tend to lose focus on their customers. Instead, they’re paying a lot of attention to department, goods, and office location costs. As a result, businesses may bear the risk of keeping unprofitable consumers, which is bad for their bottom line.

To address this, business owners must conduct a Customer Profitability Analysis. This method will help your company determine the potentially beneficial customers to have a more appropriate marketing goal. Meanwhile, your business budget will also be optimized, as you will only spend on what makes your company grow.

Now, you will find a comprehensive insight into Customer Profitability Analysis in this blog.

Definition of Customer Profitability Analysis

CPA (Customer Profitability Analysis) is a managerial accounting technique that enables companies to estimate the total earnings a customer brings in. Hence, a profitable customer is someone who generates more profits for the company than the costs that the company spends on acquiring, selling, and offering services to him.

A Customer Profitability Analysis (CPA) looks at the revenue (or profit) that every single customer produces

Moreover, Customer Profitability Analysis also enables businesses to assess their customers and determine whether keeping them would be advantageous. Then, they can decide how much it will cost to serve them or even whether to keep them or fire them based on this value.

Benefits of Customer Profitability Analysis

Conducting a CPA brings your business plenty of benefits, both for online and on-site models.

1. Reduce costs

Determining the necessary costs for luring and keeping successful customers is one of the biggest advantages of conducting a customer profitability analysis.

Conducting a customer profitability analysis can help you minimize your business expenses

With the customer profitability analysis, businesses can determine their most and least profitable customers as well as the expenses incurred for different market segments. Therefore, they can develop methods for lowering the cost in their more expensive markets.

Otherwise, entrepreneurs can completely stop supplying markets that are less profitable than others. In addition, they can reduce expenditures related to less profitable consumers and invest more in boosting income from more lucrative markets. Accordingly, businesses can rearrange their services to maximize their profitability.

2. Focus on the right market segments

As mentioned earlier, customer profitability analysis helps businesses pinpoint their most profitable customers and cut costs in less lucrative market segments. Thus, they will merely focus on the right market segments to increase profits.

Besides, once the customer segmentation has been conducted, it can be used for additional purposes. For instance, marketing teams can structure their ad campaigns based on the segment’s characteristics to attract more customers. Additionally, they can choose what offers and discounts to provide.

Typically, it takes five to six months, or a year, to break even. However, CPA can extrapolate the attributes of customer segmentations to provide the predicted duration for the ROI. Hence, businesses can determine their entire marketing and advertising budget.

3. Enhance the customer retention plan

For each market segment they serve, businesses can use a customer profitability analysis to optimize their customer retention strategy. For instance, to retain the loyalty of customers that have a high rate of profitability, businesses would want to spend more on offering premium services and benefits.

Companies should offer top-notch services and other promotions to retain potential customers.

Businesses can evaluate the costs associated with each marketing move they make and compare those costs to the profit generated per customer by using the customer profitability analysis.

The more clearly you can plan your marketing budget for each of your market segments, the more you will be able to relate marketing spending, customer profitability, and customer retention.

4. Increase operational effectiveness

Finally, performing a customer profitability analysis can assist entrepreneurs in locating any operational factors causing a particular market segment’s lower level of profit when compared to others.

Performing a customer profitability analysis can assist you in inspecting the causes of low-profit market segments.

For example, there is a specific market requiring a higher level of spending. If you spend more money on marketing but don’t receive the expected revenue from a certain demographic, it indicates that the cost of operations to serve that market is inefficient.

Once you’ve identified the problem, you may fix it by reducing your marketing expenses to put them more in line with the revenue generated.

Customer Profitability Formula

To make a customer profitability analysis calculation, you need the annual earnings per customer and the overall length of a customer’s relationship with your company.

First, the annual profit is equal to the total revenue the customer generates minus the total expenses incurred to serve the customer within a year.

| Annual profit = Total revenue the customer generates – Total expenses incurred to serve the customer |

Besides, the sources that produce the entire revenue annually include recurring revenue, upgrades to more premium plans, and cross-purchasing relevant goods.

On the other hand, customer service expenses, maintaining a customer success team, loyalty benefits, and operational expenses are the sources contributing to the total expenses.

Finally, you can calculate the customer profitability analysis by multiplying the annual profit by the number of years a customer stays with the company.

How to do a profitability analysis

Here is a step-by-step guide to performing a customer profitability analysis for your company.

1. The manual way

1.1 Determine your customer costs

Understanding your business expenses and all the points where a customer could interact with any part of your firm is the first step in the process of customer profitability analysis.

Identifying your customer costs is the first step in determining customer profitability

Other expenses for the customers may exist in addition to the costs of the goods or services they purchase. They include marketing expenses, customer service calls, shipment charges, social media uses, and return-related expenses, such as restocking or refurbishing.

Then, you can move on to the next step after listing out all of the possible expenses that your customers can incur with your company.

1.2 Segment your customer groups

To help you establish your customer groups, here are some instructional questions. What kinds of customers do you have? And why do they purchase from you, according to your line of work?

Since you are familiar with your company and its products, you can create these segments with ease. In particular, creating customer personas is an excellent method for customer segmentation. You can start developing them based on user data (demographic data), poll data, market research, and other sources.

Additionally, you can also perform an RFM analysis to divide up your consumer base into various groups. RFM analysis, consisting of Recency, Frequency, and Monetary analysis is a very thorough method of customer segmentation for a customer profitability analysis.

1.3 Collect the data

Here are some suggestions for collecting data to conduct customer profitability analysis.

Do you keep track of the customer’s interactions with customer service? You can analyze a sample of customer service requests to identify the customer segments that might contact you. Next is “Why?” which is about the causes of these costs, whether they stem from returns or customer service interactions.

Other crucial metrics include marketing expenditure and cost per transaction. When you divide these down by marketing channel and link them to certain customer segments, you may find hidden expenses.

In the end, you’ll have a list of average expenses for each action, like the cost of marketing to create a sale, the average cost of shipping, and more.

1.4 Combine all data

Now we will help you determine which customer segment will be beneficial for your business activities in the long run by looking at an example.

Imagine you have two customer segments to choose from.

| Segment 1 | Segment 2 | |

| Average revenue per transaction | $75 | $100 |

You might be tempted to change your strategy, budgets, and even the direction for product development in Segment 2 if you had only this data at your disposal. They are worth 25% more than Segment 1, after all. This data suggests that would be a wise course of action.

However, you may forget the hidden costs of those two segments. Here are the results after calculating all of the other costs.

| Segment 1 | Segment 2 | |

| Average revenue per transaction | $75 | $100 |

| Shipping costs | $15 | $35 |

| Customer service costs | $10 | $20 |

| Total costs | $25 | $55 |

| Revenue – Costs | $50 | $45 |

Without taking into account the price of the real good or service, those Segment 2 customers are actually costing you a lot of money. Considering everything, you would be better off directing more of your attention, strategy, and financial resources toward Segment 1 customers for the continued success and expansion of your company.

2. The “Pro” way

You can get the most out of your Customer Profitability Analysis only when you do it frequently and consistently. This will help you spot abnormal ups and downs in your CTLV, and CAC so you can make timely improvements.

But be aware that you may have to spend hours gathering, exporting, and processing data from multiple sources to accurately calculate your desired outputs on Google Sheets. Without a doubt, it is very time-consuming!

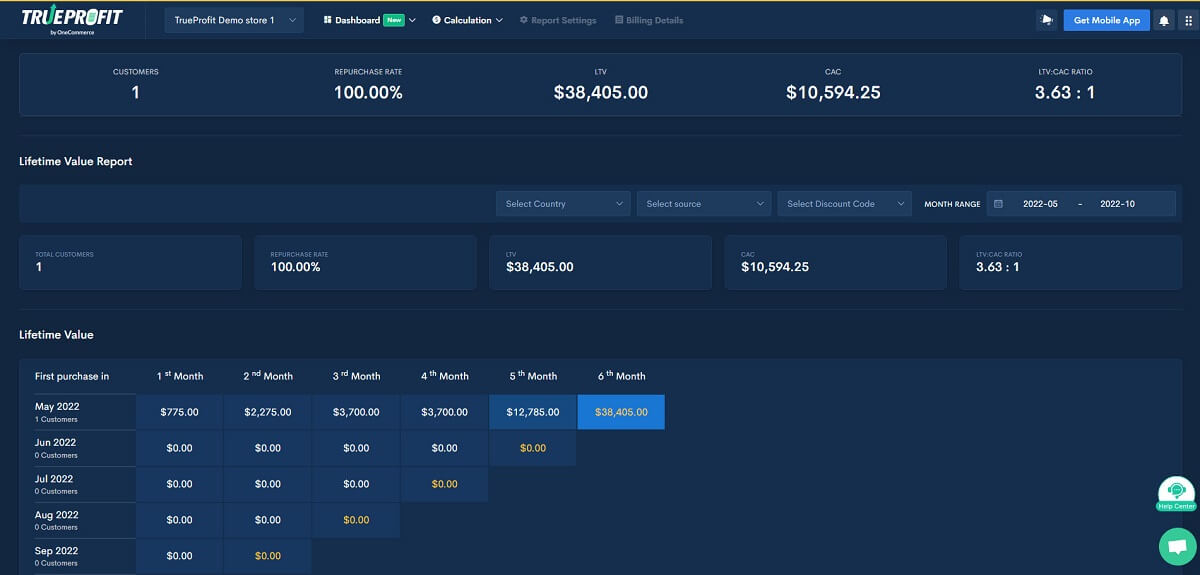

Fortunately, there is a “pro” way that helps you avoid all this manual work. And that would be using a Shopify app called TrueProfit.

With this app, you will only have to set it up once and let it do all the hard work for you. At the end of the day, you will have all important data gathered in one place and say goodbye to switching among piles of files.

You can even segment by country, source, and discount code to have a better view of your Customer Profitability

So if you want to save time for more valuable matters, install TrueProfit by OneCommerce and get all your Customer Profitability Analysis metrics automatically calculated and real-time updated.

Track all your Profits & Losses in real-time

Possible mistakes when performing customer profitability analysis

It’s important to keep an eye out for several errors when undertaking customer profitability analysis. That’s because knowing these errors beforehand will help you stay away from them. You can analyze buyer habits, spot long-term customers, and enhance customer targeting by using customer profitability analysis.

1. Consider that each product is the same

One common error that many entrepreneurs make is failing to take product variations into consideration. Instead, you must assume that every product is unique when conducting a customer profitability study.

One common error in performing customer profitability analysis is not considering all product variations

To quantify the impact properly, you must take into account all variations. If not, it will be more difficult to determine the influence of a given product in multi-product organizations.

Hence, you should make accurate customer profitability calculations as they can result in higher levels of customer retention.

2. Determine profitability based on customers rather than products

If earnings are determined against the customer, the customer profitability analysis may not be accurate. Therefore, one should not look at the amount of profit made from a single customer when doing a customer profitability analysis. Instead, profit from the product must be used to gauge the process. It means the profitability structure’s main point of concentration must be the product, and each product’s profitability must be included.

3. Forget to include all associated costs

As mentioned in the example above, businesses may make a wrong decision if they just look at the average revenue per order but leave behind other related costs.

These costs may be charges for sales, marketing, handling, warehousing, shipping, and more.

Hence, to conduct the right customer profitability analysis, you should figure out all of the possible expenses that your company pays to sell products to customers.

4. Choose the wrong time frame

The proper time frame must be chosen while doing the customer profitability analysis. Longer time periods are required for better results. This is beneficial since you can accurately estimate the customer’s lifetime value.

On the other hand, you cannot be certain whether the customer underwent product adoption if the time range is too short.

Final words

Customer profitability analysis is more than just the money a customer brings to your company. Moreover, it has a significant impact on your long-term business strategy and bottom line, so you should carefully analyze every aspect of a customer’s relationship with your firm.

As your company expands, it should be simple to update this data once you’ve decided which data to utilize and established a framework for doing a customer profitability analysis.