Table of Contents

No matter if you’re selling online or offline, you must keep close track of your Cost Of Goods (COGS) – one of the most crucial metrics that best reflect your business’ health. But what is COGS and why tracking this metric is a must?

In this article, we’ll walk you through:

- What is Cost of Goods Sold?

- Why should you track COGS?

- Formula to calculate Cost of Goods Sold?

- 4 accounting methods for COGS

Let’s dive right in!

What is Cost of Goods Sold?

Cost of Goods Sold (COGS) is the direct cost of producing your business’ products, which means it includes all the costs for labor and materials needed to produce your business’ finished goods.

And because COGS is all about production expenses, it does not include indirect costs such as marketing or distribution.

Besides labor and materials costs, COGS can also include:

- Purchased items for resale

- Purchase returns and allowances

- Trade or cash discounts

- Factory overhead costs such as energy and maintenance

- Parts for production

- Shipping and assembling the said parts into finished goods

- Storage costs

- Freight-in costs

Why do you need to track COGS for your business?

Your gross profit equals your revenue minus Cost of Goods Sold. That’s why it can be regarded as a profitability metric to assess how efficiently you are running your business.

Because COGS directly affects your bottom line, you need to reduce your COGS to increase your net profit. And in order to do that, you must track it frequently.

How to calculate Cost of Goods Sold?

Now that you have a better understanding of COGS, let us show you how to calculate it:

Cost of Goods Sold = Beginning Inventory + Purchases – Ending Inventory

In the formula above:

- Beginning inventory is the total value of in-stock products and raw materials at the beginning of your reporting period

- Ending inventory is the total value of products and materials at the end of your reporting period

- Purchases include all of the components, raw materials, and products sold to other parties during this period

NOTE: As mentioned, Cost of Goods Sold directly impacts your gross and net profit, so it’s necessary to track your COGS frequently. This will help you spot abnormal ups and downs with your COGS and make timely improvements.

To keep track of your COGS, you can design your own Excel/Google Sheets files or download a template on the Internet.

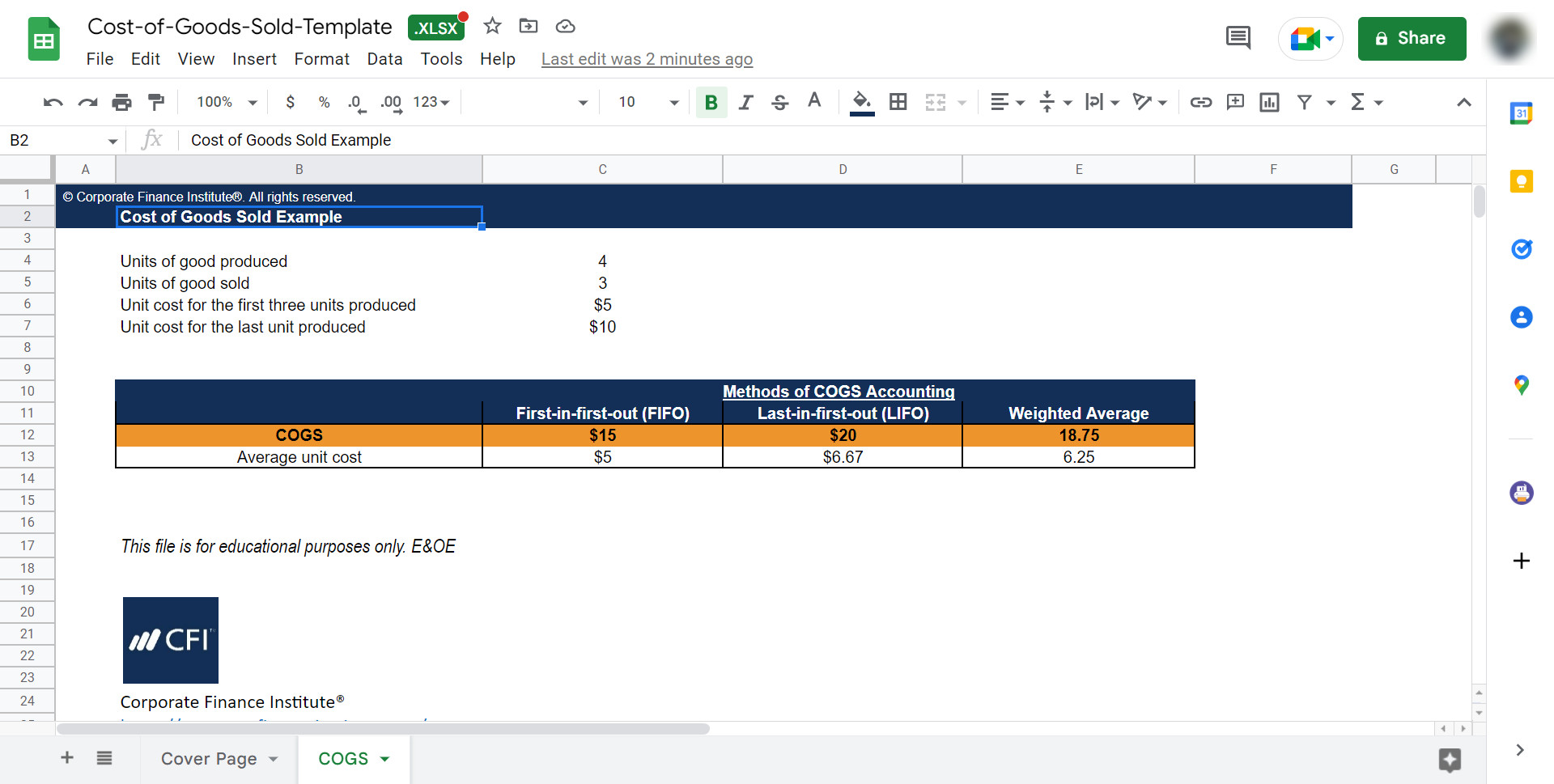

For example, here’s a simple template to calculate Cost of Goods Sold on the CFI’s website

? How to track COGS accurately for your Shopify store?

When you’re on Shopify plan ($79/month) or Advanced Shopify ($299/month), you can access the COGS report. Shopify Cost of Goods Sold calculation includes taxes and shipping costs. However, these 2 metrics vary from country to country, which can hurt your data accuracy.

So to closely monitor your COGS, you probably may want to try TrueProfit. This profit-tracking app automatically tracks your COGS (Weight-based or Quantity-based) by multiple regions so you could know your exact COGS and most importantly, your profits & losses in real-time.

Track all your Profits & Losses in real-time

4 accounting methods for COGS

Because “COGS = Beginning inventory + Purchase – Ending inventory”, different accounting methods will give different inventory & COGS values.

Here are 4 widely-used accounting methods

1. FIFO – First In, First Out method

With FIFO method, the first (earliest) products you produce or purchase are the ones you sell first. Since prices tend to increase over time, with FIFO method, you sell your lowest-cost products first, resulting in a lower COGS & higher net income.

For instance, you make 3 shirts A, B, and C that cost you $5, $6, and $7 respectively. Now during the whole reporting period, if you sell 2 shirts, your COGS would be $5+$6=$11.

2. LIFO – Last In, First Out method

On the contrary, with LIFO method, the last (latest) products you produce or purchase are the ones you sell first. As mentioned, prices tend to increase over time, with LIFO method, you sell your highest-cost products first, resulting in a higher COGS & lower net income.

Taking the same example of the FIFO method, if you sell 2 shirts, your COGS using LIFO method would be $6+$7=$13.

3. Average Cost method

As its name might suggest, with the average cost method, your COGS will be calculated using an average cost for the reporting period. This method helps blend all your costs throughout the period and smooth out price fluctuations.

Keep using the same example above, your total inventory is then $5+$6+$7=$18 and your average cost per unit would be $18/3=$6. If you sell 2 shirts, your COGS using average cost method would be $6×2=$12.

4. The Specific Identification method

With Specific Identification method, you use the specific cost of each unit to calculate COGS each period. Therefore, you know precisely which product was sold and at what cost using this method.

This method is widely used by businesses that sell unique items such as cars, real estate, and jewelry.

If it costs you $1,000 to craft a custom necklace, then the COGS of this necklace is simply $1,000.

Compare the Cost of Goods Sold to other metrics

Some of you might say that Cost of Revenue and Operating Expenses are the same thing as COGS. However, they are not.

1. COGS vs Cost of Revenue

Cost of Revenue is different from COGS because it takes into account the COGS plus all the costs outside your production like marketing and distribution.

Be noted that if you’re a pure service-based business (e.g: painters, doctors, lawyers, and carpenters), you have to list your costs as Cost of Revenue, instead of COGS

However, if you’re providing services and selling products at the same time, you can list COGS in your income statements. Take hotels and airlines, for instance, besides providing services such as lodging and transportation, they also sell food, beverage, souvenirs, and many other items. These are definitely regarded as goods.

2. COGS vs Operating Expenses

To be concise, Operating Expenses include costs that COGS do not cover.

Operating expenses may include Selling, General, and Administrative expenses ( SG&A). To be more specific, operating expenses refer to:

- Legal costs

- Office supplies

- Rent

- Utilities

- Payroll

- Sales and marketing

- Insurance costs

Final thoughts

All in all, Cost of Goods Sold is one of the most crucial metrics that you must track and monitor closely because it directly impacts your gross profit and tells you whether you can make a profit and scale up your business or not.

For the latest news, information, and updates about eCommerce, don’t forget to follow us on OneCommerce.