Table of Contents

Gross Profit is calculated by subtracting revenues from Costs of Goods Sold (COGS). Meanwhile, Gross Margin is calculated by dividing your gross profit by revenue.

Apparently, Gross Profit vs Gross Margin are two different profitability metrics that serve different purposes.

Let’s discover the differences between Gross Profit vs Gross Margin and how to calculate them properly for your business!

What is Gross Profit?

Gross profit indicates the amount of money you earn after subtracting all the costs associated with making and selling your products.

Formula: Gross Profit ($) = Total Revenue – Cost Of Goods Sold

In the formula above:

- Total revenue is the sum of income you earn from selling your products or services before subtracting any costs. On Profit & Losses statements, total revenue sits on top, so it can also be known as the ‘top line’ while net income is the ‘bottom line’.

- Costs Of Goods Sold refer to all the direct costs associated with producing your finished goods. This includes costs of labor, materials, purchased goods, etc.

What is Gross Margin?

Gross margin, also called Gross Profit Margin, is calculated by dividing gross profit by total revenue. This metric is used to measure your business’ financial efficiency. To be more particular, how much profit you can secure per dollar after deducting all the direct costs.

Formula: Gross Margin (%) = (Gross Profit / Total Revenue) * 100%

| ? Further reading: |

Gross Profit vs Gross Margin: So what is the difference?

Clearly, gross profit is a flat amount of money while gross margin is in percentage. And it should be noted that you should view both metrics for a complete picture of your business’s performance.

For instance, suppose that Company A and Company B sell the same product lines and they both have a Gross Profit of 1 million dollars. But Company A’s revenue is 2 million dollars and Company B’s revenue is 20 million dollars.

In this case:

- Company A’s GPM = 1/2 = 50%

- Company B’s GPM = 1/20 = 5%

So if you just look at the Gross Profit, you won’t be able to tell that company A is 10 times more financially efficient than company B.

What we’re trying to convey is that Gross Profit and Gross Margin have different purposes:

-

The purposes of Gross Profit

Calculating your gross profit will reveal how much money you will make after expenses during a specific time period. This can help you figure out how much profit to reinvest into your company.

And since Gross profit is revenue subtracted from COGS, analyzing your Gross Profit together with revenue and costs will give you an idea of how good you’re at managing material and labor costs.

-

The purposes of Gross Margin

Whereas, you should calculate your Gross Margin to do long-term planning. If your gross margin is steady over a sustained period, you can forecast a certain gross profit for every dollar of sales you make.

As you have a better understanding of your company’s financial situation, fully understanding your gross profit margin can help you run your operations more efficiently.

Track all your Profits & Losses in real-time

Example of Gross Profit vs Gross Margin

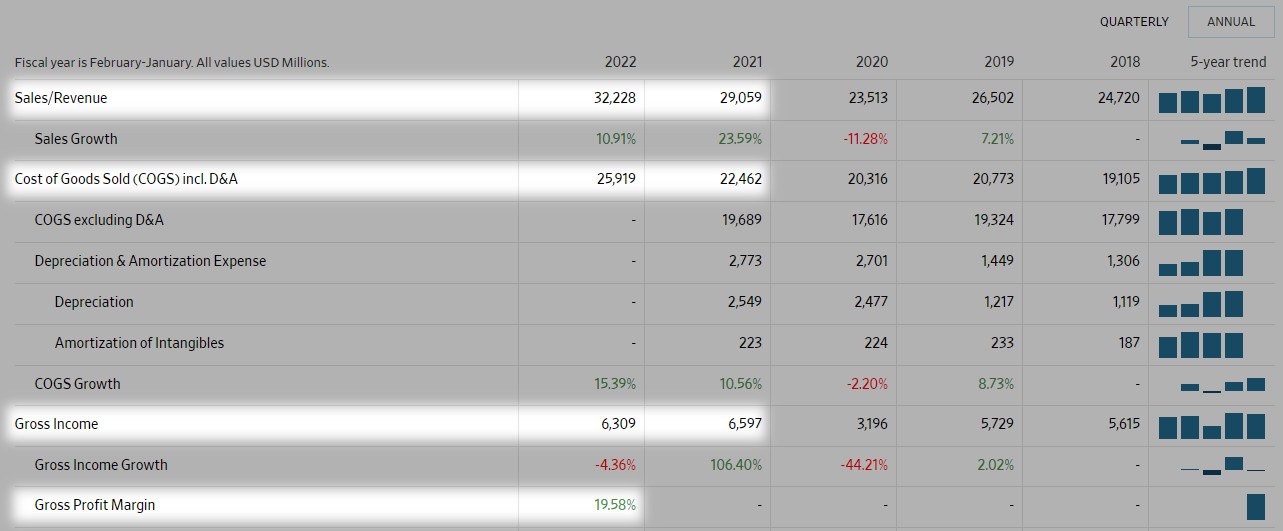

Take a look at the consolidated Profit & Losses statement of Starbucks in the year 2022:

- Net sales = $32,220 billion

- Cost of goods sold = $25,919 billion

So Starbucks’ Gross profit in 2022 is $32,220 billion – $25,919 billion =$6,309 billion. And the brand’s GPM = $6,309 billion / $32,220 billion = 19,58%.

Wrapping up!

All in all, Gross Profit vs Gross Margin are the most crucial metrics that reflect your business’s financial health. However, the 2 metrics serve different purposes in analytic comparison. Therefore, you should view them side by side for a complete understanding of your brand’s profitability.

Discover top-tier eCommerce applications & services at OneCommerce.io