Table of Contents

Amazon has launched the Amazon BNPL service to bring a more convenient payment method to their customers. The platform has teamed up with many financial businesses to expand this service across the world, including the Affirm BNPL option.

Learn how you can benefit from the Amazon Affirm partnership in this article!

Who is Affirm?

Affirm is a San Francisco-based financial technology startup which was started by PayPal founder Max Levchin.

The company seeks to provide a rapid, transparent, and more accessible lending alternative to credit cards. To do that, it allows customers to take out microloans at the point of sale with partner retailers.

Affirm is a US-based BNPL provider and has collaborated with many businesses

They claim in their mission that their service comes to life to bring honest financial products that improve the lives of customers. Indeed, Affirm has expanded its partnership with Amazon to offer an installment-based payment option for U.S. users.

The Amazon Affirm partnership

The number of active consumers and merchants on the Buy Now, Pay Later (BNPL) platform has been growing fast. Hence, Amazon has made a deal with Affirm Holdings Inc. to allow customers to pay for their purchases of 50$ or more in installments.

Amazon Affirm partnership has formed a monthly installment option to attract more customers

In return, Affirm will provide the exclusive BNPL service for the U.S. Amazon until Jan. 31, 2023, under the terms of the deal. Amazon also gets warrants to purchase shares of Affirm’s Class A common stock.

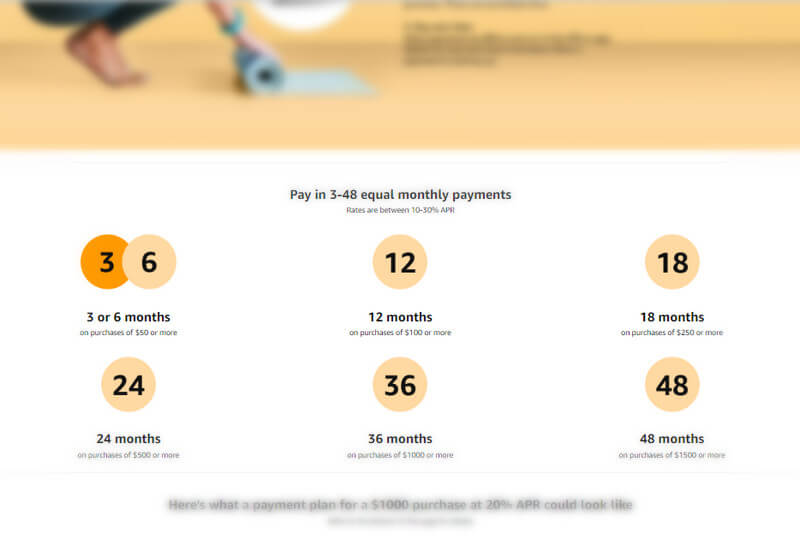

The Amazon Affirm agreement provides customers with a plan to spread their purchases into installments over 3 to 48 months, with interest ranging from 0 to 30% annual percentage rate.

Approved customers will see the total purchase price upfront after getting approved. Moreover, they won’t need to pay extra costs for their late payments or hidden fees.

The Amazon Affirm partnership allows items like furniture, home goods, electronics, and fashion to be paid with the monthly installments plan.

Unfortunately, products from Whole Foods Market, Amazon Fresh, and certain digital purchases like movies or Kindle books, gift cards, and carts under $50 will not be eligible.

Amazon Affirm BNPL payment plan

Based on your credit, your interest rate will range from 10% to 30% APR (Annual Percentage Rate). Payments through Affirm are subject to an eligibility check and may not be available in all states. Payment choices vary by purchase, and a Down payment may be required.

According to Amazon, you will pay from 3 to 48 equal monthly payments with APR rates ranging from 10-30%

| For example, a $800 purchase could be divided into 12 monthly payments of $72.21 at 15% APR, or 4 interest-free payments of $200 every 2 weeks. |

The detail of a payment plan for a $1000 purchase at 20% APR, according to Amazon:

| Duration | Interest | Monthly Payment | Total amount |

| 3 months | $33.52 | $344.51 | $1,033.52 |

| 6 months | $59.14 | $176.52 | $1,059.14 |

| 12 months | $111.61 | $92.63 | $1,111.61 |

| 18 months | $165.74 | $64.76 | $1,165.74 |

| 24 months | $221.50 | $50.90 | $1,221.50 |

| 36 months | $337.89 | $37.16 | $1,337.89 |

| 48 months | $460.66 | $30.43 | $1,460.66 |

How to use Affirm on Amazon.com

In this part, we will show you how to make a payment using Affirm. It is just as easy as pie:

- Step #1: Fill your cart with your wanted items

- Step #2: Select Affirm as your payment method when you check out

- Step #3: Enter your information and receive a real-time decision

- Step #4: Choose how to pay

- Step #5: Pick the preferred payment schedule that is suitable for you.

Pros and Cons of Affirm BNPL option

The Amazon Affirm partnership has brought a beneficial way to pay for its customers. However, not all customers from around the world can take advantage of it. Take a look at the pros and cons of the Affirm BNPL service.

The Amazon Affirm’s BNPL service is not perfect for all but it is still a good choice for some customers

Pros:

- You can pay off your purchase early as there is no penalty for doing that.

- When you open an Affirm account or verify your eligibility, your credit score will not be affected. As a result, even if you’ve been turned down by Affirm in the past, you might be able to pay over time at Amazon utilizing Affirm financing.

- You can customize your payment option based on your Amazon purchase and your application.

- You can return an item bought with Affirm.

Cons:

- Your payments may be reported to credit bureaus when you purchase with monthly payments through Affirm.

- You won’t be able to utilize Affirm to pay for your Amazon purchase if it’s being sent outside of the United States.

- Affirm is not eligible for all purchases.

Final thoughts

As online shopping is thriving stronger and faster, many eCommerce platforms are starting to bring convenience to customers’ tables in terms of payment methods.

Amazon doesn’t want to stay out of the game, so it builds a partnership with Affirm to offer its U.S. customers a flexible payment option. The Amazon Affirm partnership forming the BNPL service helps reduce cart abandonments and increase the conversion rate.

Now, get the things you want on Amazon and pay over time with Affirm!